Affordable Patient Financing

It’s no secret that most home healthcare providers spend an inordinate amount time engaging various payors on behalf of their patients. Billing insurance… following up with insurance… checking billing codes… and answering patients as to why their much-needed equipment is taking so long to get to them… it all can be very frustrating.

In this day and age of the "Silver Tsunami" and competitive bidding, many patients (or children of patients) are willing and want to purchase their own equipment. Most patients will use their equipment daily—if not constantly (as is the case with portable oxygen concentrators)—and want to have the best of the best. But sometimes they can’t pay cash. So how can a provider give patients what they want without losing money due to bidding?

The answer is to offer your patients smart financing they can afford.

Patients may have traditional credit cards but may not want to use them for a variety of reasons. That’s why many providers offer two modern types of financing for patients: CareCredit and OxyCare TOTAL Advantage™.

Care Credit

The Care Credit Card is different from Visa, Master Card, American Express, and Discover cards because its focus is strictly on medical care. It helps your patients pay for out-of-pocket expenses not covered by medical insurance by extending flexible financing options that they can’t get when using Visa or MasterCard. Patients can use Care Credit at thousands of medical-related outlets, such as at a chiropractor or veterinarian’s office. Care Credit is one the largest (possibly the largest) credit card providers in the United States, with a great reputation. Providers can sign up with Care Credit for free.

OxyCare TOTAL Advantage

OxyCare TOTAL Advantage allows patients to pay for their equipment in 24, 36 and 50 month terms, for a fixed monthly payment. While the patient pays monthly for the term, the provider gets paid in full within 24-48 hours of the sale, and the provider assumes no risk. In other words, if the patient defaults in month 6, for example, the provider does not have to refund the sale. OxyCare TOTAL Advantage can extend credit to lower FICO scores, so that even patients with low credit scores can take advantage of the program. Providers can sign up with OxyCare TOTAL Advantage for free.

So which financing option should providers offer?

BOTH! — OxyCare TOTAL Advantage and Care Credit are different programs that provide widely different patient financing options. OxyCare TOTAL Advantage can accommodate FICO scores as low as 500, and the program is very much like a furniture or other retailer’s store credit plan. The Care Credit card is a specialized medical products credit card designed to improve the lives of your patients with innovative options and services. Only Care Credit offers your patients features such as insurance that pays off if a patient can’t pay, dies, or is disabled. And it allows patients to keep their traditional credit card balances open for other needs or emergencies.

Be wise in today’s world of credit. Use OxyCare TOTAL Advantage and Care Credit to capture sales you might otherwise have lost. Contact financing@oxygo.life to get started today!

Finance FAQs

Why would my patients want OxyCare TOTAL Advantage or Care Credit if they already have other credit cards?

MasterCard or Visa credit card holders are what we call Responsible Credit Users or “RCUs”. RCUs know how to use credit responsibly and will recognize the unique insurance and other advantages that OxyCare Total Advantage and Care Credit offer over their current credit cards while in your store. Neither MasterCard nor Visa are designed or have the many unique & often exclusive features required by patients.

Why can’t a provider wait until a patient asks for OxyCare Total Advantage or Care Credit and then sign up?

The idea is for you, as a provider, to be proactive—not reactive. Many patients simply do not know about these new credit programs that are much more flexible and payment-friendly than anything they may have used before.

Providers shouldn’t wait for their competitors to provide HME equipment that vastly improves the patient’s quality of life. Providers should learn about these great programs, often with little or no cost, and reach out to their patients. They shouldn’t wait for another reimbursement cut or their own financial crisis to take action. Sign up now!

Is the provider responsible for the loan or credit card charge?

No, these are non-recourse loans or charges. The provider is not responsible. Common sense says, though, that if you see or suspect something fraudulent—report it. This would be true for any business transaction.

Is this the credit future of HME Providers?

Yes, absolutely! These credit programs should be a vital part of any provider’s future.

As one DME offering OxyCare TOTAL Advantage in Arizona told us: “It has opened up revenue gains for us I never thought possible, in just the first few days of my signing up. I am going to start advertising it on my box truck!”

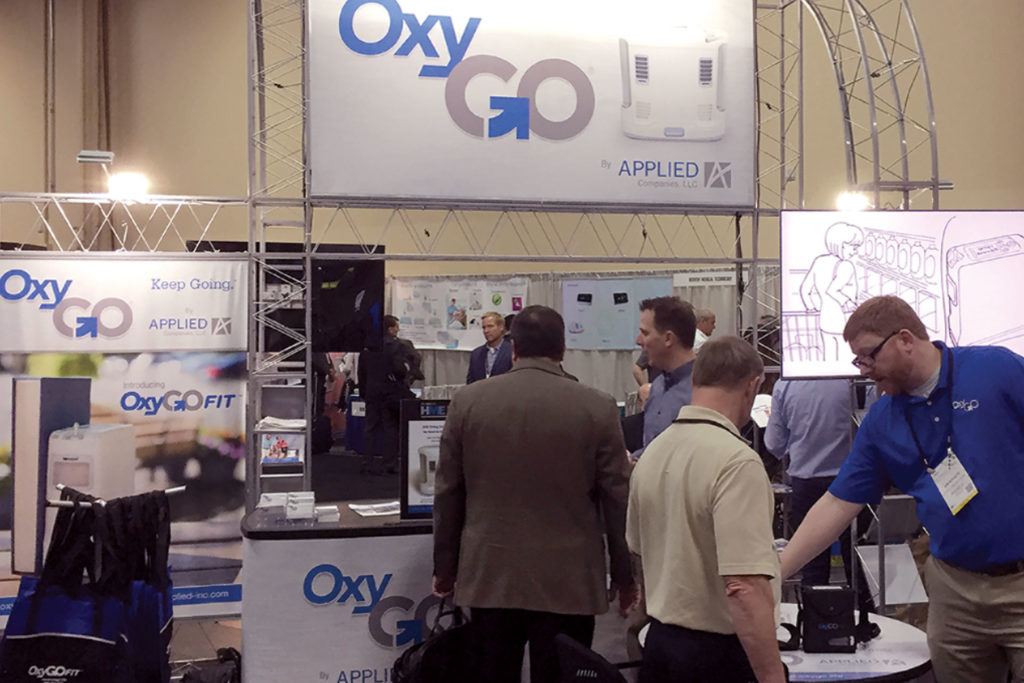

OxyCare TOTAL Advantage is not a credit card. OxyCare TOTAL Advantage is fixed-term financing with low monthly payments—just like a car loan! Patients can apply to finance all of the OxyGo family of portable oxygen concentrators, either the OxyGo or OxyGo FIT™. They can also use OxyCare TOTAL Advantage to buy other home healthcare equipment from your business!

Patient Financing Options:

- Credit amounts of up to $10,000…completed in minutes

- Term contracts of 24 to 60 months

- Low monthly payments

- Finance OxyGo, OxyGo accessories, or any other home healthcare equipment

- Easy automatic payments

- Same-as-cash options available

RELATED POSTS