2018 Med-Tech Trends

Technology continues to transform every industry—and home healthcare is no exception.

As new medical tech trends continue to emerge, it can be difficult to stay up-to-date on all of them. Here are a few of the most impactful trends to keep an eye on as fast-developing healthcare technology accelerates marketplace change.

Hi-tech healthcare innovations that improve patients’ lives may be an opportunity for DMEs to further diversity their product offerings. Consider, for example, cash product sales related to diabetes that are now available and in the development pipeline. It has been estimated that 86% of all healthcare spending goes to patients with one or more chronic medical condition.

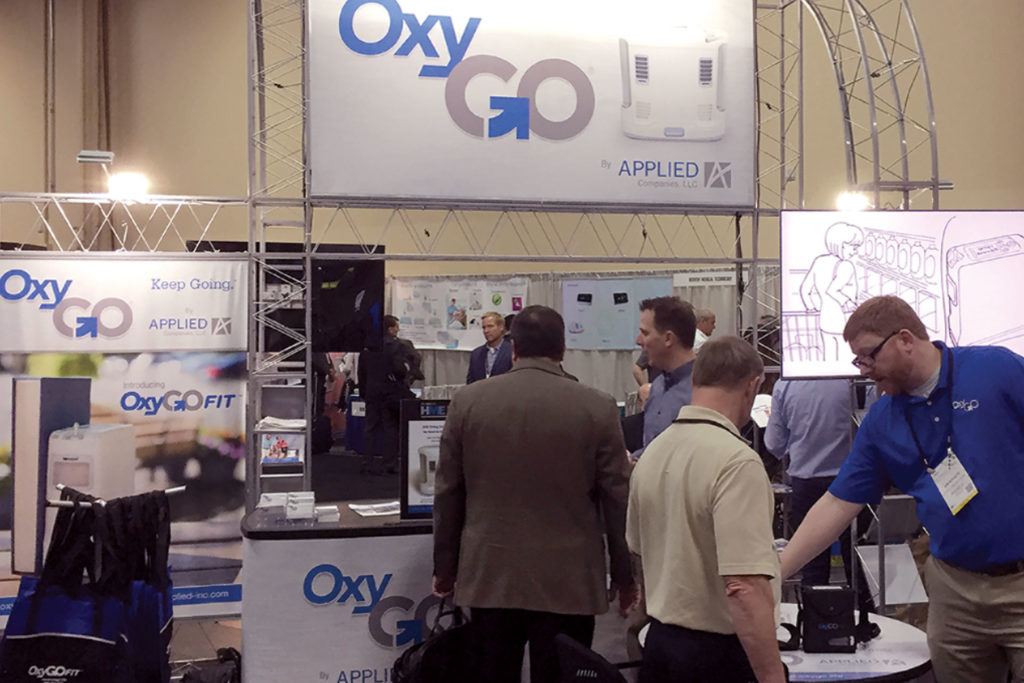

At recent Medtrade shows, diabetic supplies—especially continuous glucose monitoring devices (CGM)—have drawn increased provider interest as cash sales items. These include glucose meters where competition appears to be fierce. There are more than 90 different types and brands available. Several Medtrade booths have recently displayed glucose meters. Expect to see more companies marketing diabetic related products exhibit at future Medtrade shows.

Products reported under development in the diabetic pipeline include:

- Patch pumps for type 2 diabetic insulin users

- Infusion set improvements. They are needed to get insulin in a pump from the cartridge to just under the skin.

- User friendly delivery methods for Clucagon—a rescue medication for a person with diabetes who is unconscious or who suddenly can’t eat or drink something with glucose.

- Infusion pen memory aids that show when the last dose was delivered.

- More fashion-conscious meters, pumps and other diabetes-related medical devices.

Thomas Laur, global president SAP Health, sees digital innovation driving dramatic changes in healthcare. “Digital innovation will fuel the next wave of breakthroughs in healthcare and accelerate the broader shift toward data-driven care for healthcare organizations,” said Laur.

Looking forward at developing healthcare trends, he notes increased emphasis on technology that protects against cyber threats and data breaches. He also comments on the emergence of advanced medical devices, sensors and wearables that provide patients and healthcare providers an opportunity to reap potential benefits from extended monitoring, greater disease prevention, and improved fact-based care decisions.

Laur, as reported by medical economics writer Tracey Walker, draws five conclusions from a recent survey about where healthcare organizations are investing in technology most heavily:

1. Technology that improves efficiency

With increased cost pressures, healthcare organizations are striving to standardize and streamline administrative processes for greater efficiencies and improved operations.

2. Technology that supports decision making & personalized medicine

With aging demographics and the rise of chronic diseases, organizations are increasing investments in big data and analytics that can support simpler decision-making while providing data-driven insights for personalized clinical treatments and optimized patient outcomes.

3. Technology that empowers patients

Digital empowered and connected patients have greater expectations for readily accessible and valuable healthcare insights. “The early prioritization to patient experience and digital engagement practices reflects the movement toward helping patients better navigate the healthcare system, empowering them to take active roles in monitoring and managing their health, and in the facilitation of open and immediate communication with the healthcare provider network—all with digital services,” Laur says.

4. Technology that protects against cyber threats and data breaches

The shift to a connected digital healthcare network elevates the need for improved security and privacy, and this is reflected in increased investments in security.

5. Technology that improves remote health monitoring

The emergence of advanced medical devices, sensors and wearables provide patients and healthcare providers an opportunity to reap the potential benefits of extended monitoring, greater disease prevention, and improved fact-based care decisions. Healthcare organizations are continuing their investments to support these emerging opportunities.

DMEs should consider emerging opportunities that exist for sales of robots and telehealth services. Both are looking like huge markets of the future. Experts predict telemedicine/ health could become a $34 billion market by 2020 as healthcare professionals become more likely to contact patients via telephone and video chat. This is especially true with remote verification and drug administrative oversight becoming technically easy to implement. Several medical tech futurists predict sales of personal robotics to help patients on the home front could reach $20 billion by 2020. Blink and you may miss it.

The velocity with which new medical technology is becoming available has two speeds: fast and faster. The FDA has goosed the wheels by backing a pilot pre-certification program that reduces the wait time and cost of market entry for MedTech devices. With this program the FDA has skipped analyzing the product and instead focuses on the developing company. If the FDA approves the company, they can build safe, reliable and high-quality devices without needing approval on each individual product the company develops.

Last, but not least, is the growth and impact of e-commerce on homecare providers. Sink or swim, brick and mortar providers need to be do a better job of engaging customers with products in their stores and around the world. Think of something fun and attention grabbing to entertain and instruct store visitors. Extend the human touch and take advantage of the impersonal nature of just about any computer to reach the heart and soul of your patients. Keep internet competitors at bay. Filling in that gap might be your most important lifeline in being able to keep store revenue climbing.

RELATED POSTS